A competitive landscape and changing customer demands means that it has never been more important to deliver a winning customer experience. There’s no avoiding it, embarking on a journey of digital transformation is vital for banks to improve their customer service.

However, creating meaningful change within customer support can be challenging for retail banks or credit unions – especially without a commitment from the top to encourage and oversee the implementation of new initiatives.

That said, with a mindset shift from top down, banks can integrate innovative new tech solutions to offer superior customer experiences, positively impacting the customer’s trust in the financial organization.

What is customer experience in banking?

Customer experience in banking is an all-encompassing term that takes into account everything related to a support request or advisory. That means it’s not just limited to conversations with agents or advisors, but the experience on each and every touchpoint.

Above all, the goal is to achieve consistency across these touch points, whether mobile banking apps, in-branch visits, the Live Chat channel, and so on. From the first day when customers are being onboarded to every subsequent support interaction, the service needs to meet expectations or even exceed them.

But how do you achieve this? Here are our proven strategies for banking industry players to take their omnichannel customer experience to the next level, while boosting engagement and efficiency in the process.

1. Put the customer at the heart of your strategy

A positive customer experience depends first and foremost on delivering on customer expectations. Any new strategies must begin by taking the customer’s perspective into account. Focusing on average handle time (AHT) rather than customer-satisfaction scores, for example, puts the emphasis on productivity and costs rather than the overall customer experience.

Focusing solely on KPIs without considering the real-world experience can have a negative effect on perception. It’s important to remember that customers want to feel understood. Your AHT may be low, but if customers don’t feel they’ve had a satisfactory resolution, it’s not going to improve satisfaction.

A wholly customer focus

Instead, make it clear you are listening to the customer and taking on board feedback to provide better customer service. Consider each bank customer request and interaction as an opportunity to learn what works and what doesn’t work, reflecting on the journey as a whole rather than individual touchpoints. To make customer experience a priority, designate a Chief Customer Officer with direct access to the CEO, highlighting the importance of all efforts to improve customer service.

The reason this is so important is because just one negative interaction can damage customer satisfaction levels. You need to deliver a positive experience that enhances customer engagement across the entire journey – whether that’s in a Live Chat conversation or an in-person meeting.

Efficient services across channels

Customers should be able to start a loan application online, for example, and continue it later in the branch if they desire, seamlessly picking up from where they left off. To discover the pain points in transactions such as opening an account or exploring investments, it’s recommended to map out the customer journey and eliminate any obstacles.

2. Identify specific customer pain points

This point of identifying customer pain points should be at the top of any bank’s agenda to improve customer service. In general, customers expect quick answers on the channel of their choosing and anything less than this would be considered a pain point.

Given the broad variety of channels on offer, the trends show that the only way to meet expectations is to provide a broad number of channel options on mobile devices. In fact, 89% of the population currently uses mobile banking applications and when you look only at the Millennial age group that number rises to 97% (Insider Intelligence). But there is still work to be done. A Capgemini survey revealed that a mere 35% of respondents were highly satisfied with their banking app experience, in contrast to the 59% who reported dissatisfaction.

More mobile experiences

Unsurprisingly, many retail banks have responded and mobile banking apps and online banking as a whole has gone from strength to strength. Banks are better able to offer customers robust self-service options as well as easy access to human contact via customer service agents. However, even with the strength of mobile applications, the bank branch experience shouldn’t be overlooked. Reports show that 82% of customers view having a physical branch as extremely or very important, even though 24% expect to use one less often in the future (EY).

This trend appears to be proving consistent year on year, with a more recent report suggesting that 72% of customers intend to use their branch at a similar level to the previous year, and 38% consider them to be indispensable.

Seamless interactions overall

Overall, even with the heightened capabilities of mobile banking, financial services institutions need to remain vigilant to identify gaps in their customer service experience. By doing this and discovering hidden pain points, support teams can make targeted efforts to improve specific stages in the customer journey.

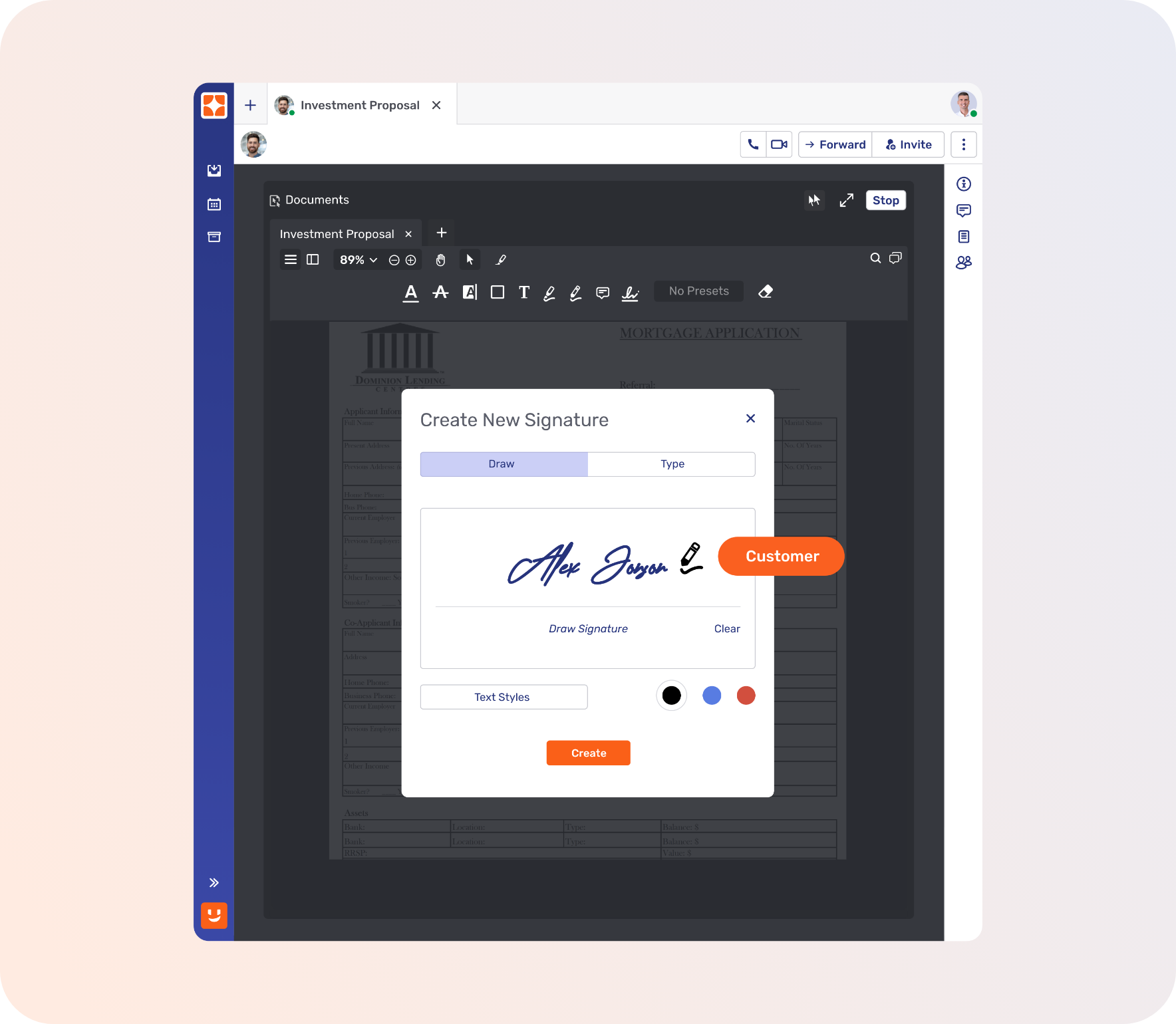

Getting a signature for forms is a good example of this. Having to send out paperwork delays the sales process, meaning agents can’t close during the first conversation.

Customer feedback and analytics would expose this particular problem, which could then be resolved using a combination of Co-Browsing, Live Chat, and e-signature to complete documents more efficiently.

3. Prioritize a great onboarding experience

The moment directly after purchase is an important moment in setting the tone for a new banking customer relationship. If a customer is opening a checking account or taking out a new financial product, this is likely to be an official onboarding process. However, onboarding sits at the crux of inefficiency for many banks. Due to large amounts of personal and legal data, it can take weeks to complete a process – especially when these are paper-based, manual processes.

It’s vital that firms look for ways to optimize onboarding, but few are taking the steps to do so. According to The Digital Banking Report, a shocking 47% of companies don’t have a formalized onboarding process (The Financial Brand). With a lot to gain from using the onboarding process to make a first impression, enhancing processes and service standards for this stage of the customer journey is likely to help banks stand out.

4. Personalize the customer journeys with data and analytics

Data-driven personalized experiences are the key to ensuring positive customer journeys that make financial institutions stand out from the competition. However, gaining valuable insights also presents a sizable challenge, particularly in a banking context.

Any usage of customer data needs to be secure, transparent, and ethical, which is no easy task for service professionals looking to gain actionable insights. A Capgemini report found that 73% of bank executives say turning loyal customer data into usable patterns and trends is a significant challenge, with most of them (95%) claiming that restrictive operating systems (Capgemini) are the reason behind this difficulty.

On the other hand, failing to use the data collected can have a serious impact on product improvements. The threat of fintech companies is ever present, and keeping on top of innovation and data-driven insights is essential to remain competitive.

Opportunities for deeper personalization

What’s more, unlike even agile fintech companies, traditional banks have a huge well of data thanks to their extensive customer bases that they can use to develop laser-focused financial products. The banks that are able to overcome the challenges and tap into this well will be able to provide a personalized journey that fully meets customer needs.

5. Embrace self-service options

Self-service options, whether portals, mobile apps, artificial intelligence (AI) chatbots, or FAQs were historically useful tools that allowed customers to resolve simple questions or common inquiries.

Now, they’re so much more.

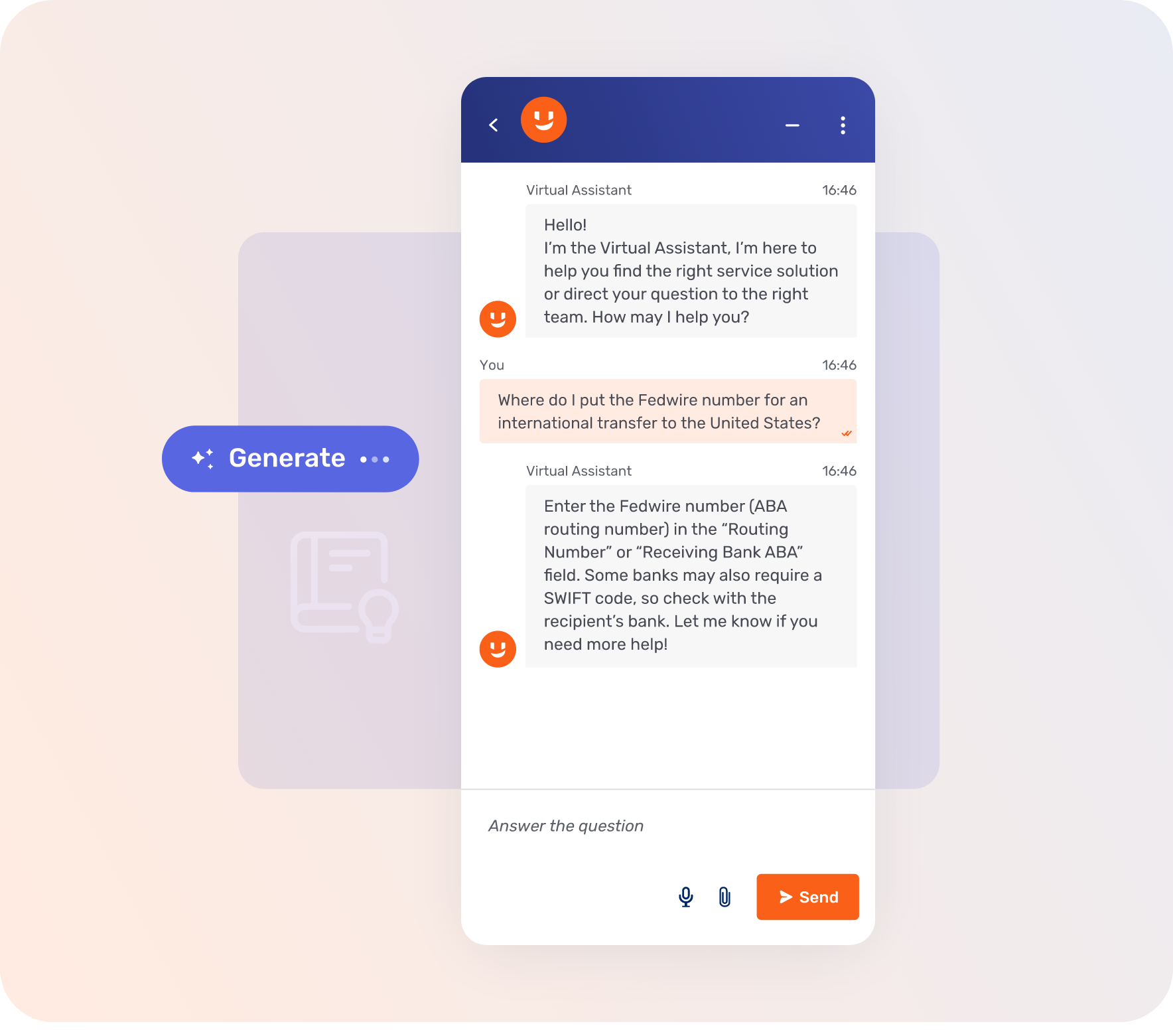

With the rise of Generative AI, chatbot technology has transformed the contact center experience becoming more than a simple self-service tool to become AI-powered virtual assistants that help both customers and agents alike.

That said, some financial institutions are proving slow on the uptake. A Capgemini survey of bank employees rated contact center automation and digitalization as low to moderate. This is something that needs to change as agents currently spend up to 70% of their time on operational activities, which is much too high given the technology available today.

Assisting with complex tasks

The most advanced technologies and machine learning capabilities are now even able to handle complex journeys. For example, AI-powered smart conversation flows can be set up to provide a fully interactive and consistent experience that draws on the bank’s own knowledge base and other predetermined rules to offer a journey that was previously impossible.

This is just as true for the agents themselves, who can use the digital platform at their fingertips to get answers at the drop of a hat, suggest relevant product recommendations, translate between languages, or more.

Humans are still needed

However the personalized service experience that customers can get from human interaction will always be important, particularly when it comes to getting reassurance. If a self-service platform fails to resolve the issue, the customer must be able to get in touch with a human agent easily, otherwise it will lead to a poor experience.

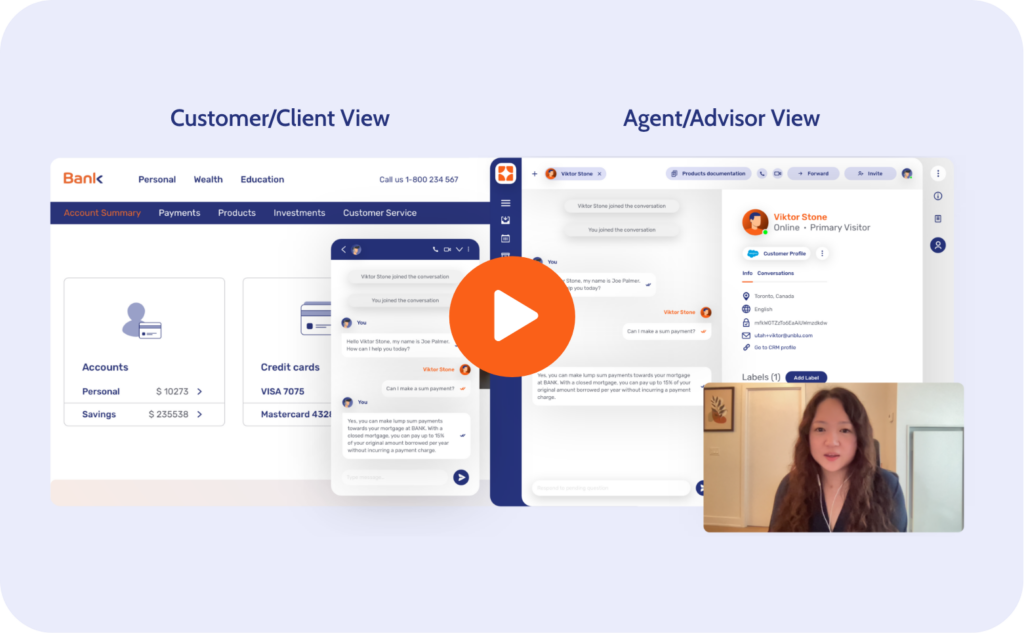

These were the findings of a Deloitte survey on customer preferences regarding chatbots and human agents. The report states that customers are willing to use chatbots or similar automated digital channels, provided the query can be handled by the digital technology. But there is a very definite limit on their usability, and for more complex needs like taking out a mortgage or financial advice, real-time interactions are essential (Deloitte).

Forrester further backed up these findings, with a report claiming that hybrid experiences scored higher on effectiveness, ease, and emotion than either digital-only banks or physical-only options (Forrester).

For traditional banks who are looking to update their digital service offering, this is an important point. The temptation is to throw all your eggs in one basket and focus solely on intelligent technologies. This may lead to a poor customer experience unless it’s also accompanied by well-trained human agents.

Hybrid is the way forward

Investing in next-level chatbot technology is essential. It’s no longer just about reducing high numbers of calls with self-service alternatives – although this is still a primary use case. The fact is, chatbot technology goes far beyond this, leveraging and enhancing the capabilities of both digital experiences and human support to offer digital experiences that rival even the biggest tech companies.

6. Don’t underestimate the importance of loyalty

There’s less of an emphasis on loyalty than there once was, at least among public perception. Where once families may have collaborated with the financial institution for generations, now individuals are happy to change financial providers if they get a recommendation from a source they trust.

What’s more, the trends show that loyalty is increasingly tied to the quality of the AI technology in use at the bank. With a robust AI framework in place, there is more time for agents or advisors to spend directly on client relationships. Moving forward, this will be one of the most important avenues to increasing loyalty.

Excellent customer service

While there’s no definitive answer to why, the general consensus is that because service expectations are high, if customers don’t get the banking experience they feel they deserve, they will move to another provider. We can see this trend most commonly among the younger generations, who openly claim that financial providers don’t care about their needs. In fact, 33% of respondents in a survey carried out by EY claim that a bank is their most trusted financial services brand. This is significant because the once-outsider fintech firms currently enjoy 37% of the confidence vote, surpassing incumbent institutions (EY).

Ensuring strong relationships

However, although customer loyalty doesn’t exist in the same way it once did, that doesn’t mean it isn’t important. It simply means that banks have to work harder to secure it by providing a consistent and delightful customer experience.

Take the onboarding process for example. A J.D. Power report found that if the customer receives up to seven messages in the first six months, satisfaction increases (The Financial Brand). The same rise in satisfaction due to communication can be seen in a wealth management context. Clients who meet with their advisors more than four times a year are twice as likely to feel optimistic about their financial situation, which helps boost retention in firms (VouchedFor).

7. Promise your customers transparency

Securing the trust of customers is of the utmost importance and customers will place more confidence in providers if they believe they are being told the truth.

There are two aspects to this. Firstly, security should be a high-agenda issue for every bank as malicious actors increase and cases of fraud threaten all institutions. Proactive security measures are and should be central to all banks activities.

Build customer trust through security

This comes as no surprise and financial security has always been a strong area of focus for banks. However, when it comes to customer perception, security alone isn’t enough. Instead, even the largest banks also need to be transparent with customers regarding their security practices, even in the case of a privacy breach.

In general, being as transparent as possible in every customer interaction is the only way to retain trust. Outside of the security context, clients should have access to all the information they need for product details, terms and conditions, prices, ownership over financial data, and any other part of the exchange.

8. Commit to digital transformation

An omnichannel digital strategy allows banks to offer customers a more convenient, flexible, and personal service, boosting engagement, satisfaction, and loyalty.

Progress is being made in the financial services sector, with 35% of global banking executives claiming to be happy with the development of their digital banking initiatives.

However, the progress made is far from enough to allow banks to sit back and rest on their laurels. Given the context of customer expectations, there’s still a huge number of banks that are not happy with their progress or don’t have any yet to speak of. Statistics show that 12% of banking executives are stuck in the planning stage with a further 6% who don’t have any transformation plans at all (Forrester).

There’s a certain amount of reluctance to change in the banking sector, often due to the admittedly sizable challenges involved in achieving a wide range of digital banking services. However, an omnichannel strategy that balances traditional and digital tools is simply indefensible and banks need to commit to digital transformation to provide the exceptional customer service that will guarantee success.

9. Don’t be afraid to fail

Customer needs, demands, and expectations continually evolve and digital transformation is an ongoing process. And so no matter how well thought through your digital initiative, there will always be unforeseen problems or places where it can be improved. Strive for continuous improvement over instant perfection. Embrace constant iterations, regularly evaluate features, and adjust and hone strategies based on feedback and analytics.

Making the customer experience more engaging within financial services requires the integration of digital solutions, creating a service that is flexible, personalized, and efficient. However, the impact of these high-tech solutions will depend on commitment from the top to make exceptional customer experiences a priority – plus the willingness to take on board feedback and constantly adjust and improve the service.

Digital banking customer service & Unblu

Discover how Unblu’s range of innovative conversational banking solutions can help key players in the financial services industry to transform their customer service experience. Provide superior banking services and improve satisfaction with a seamless journey from start to finish, eliminating pain points and resolving issues faster and more efficiently.

Want to find out more?

.png)